Traditional Finances provides the public with five years worth of financial statements and budgets along with payment information in detailed, downloadable data for at least three years.

The District has three main funds, The General Fund, for normal operating expenses, the Debt Service Fund for debt service collection and payments, and the Capital Projects Fund for capital projects and construction. The General Fund contains normal operating revenues and expenditures and general operating items. The General Fund also encompasses the Operations and Maintenance reserves that may be needed to be used for any of the mentioned funds. The Debt Service Fund receives property tax revenue as designated by specific defined areas to pay the bond payments associated with that area. The Capital Project Fund is designated specifically for capital projects. Any bond proceeds related to capital projects are received, allocated, and expensed as appropriated in this fund. Note that the District does not receive any sales tax revenues, but collects them from customers who opt into the trash service with us as they are pass-through collected for and paid to our third-party trash collection company.

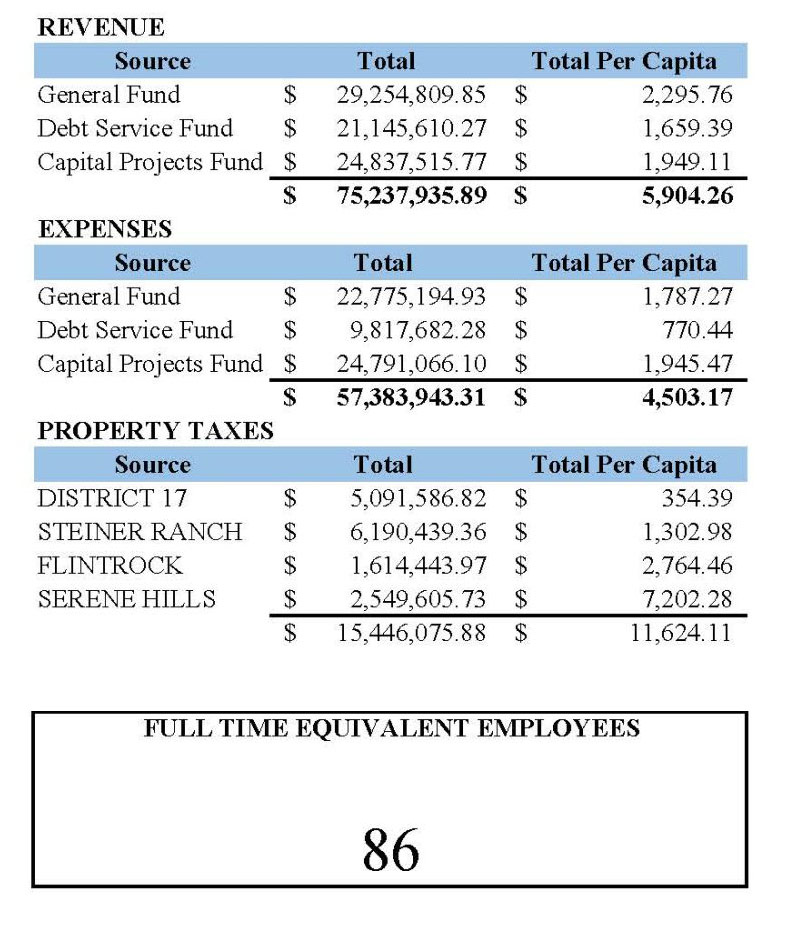

Below is the Fiscal Year 2023 and Expenses per related Capita; Property Taxes Per Defined Area and Per Capita as well as the number of Full Time Equivalent Employees (FTE’s)